If you just received STOCK from a startup, and that stock is subject to VESTING, then file an 83(b) election within 30 days.

30 Day Deadline. You must mail the 83(b) election to the IRS within 30 days after you receive the stock.

No 83(b) election for options (unless you ‘early exercise’).

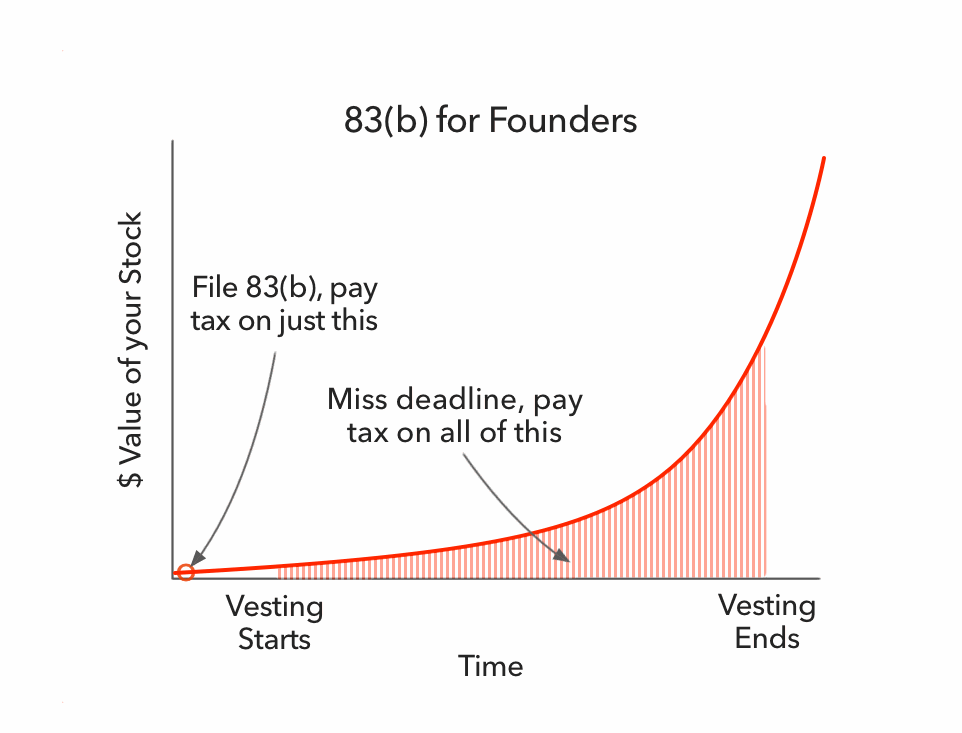

Without 83(b), you pay tax on the paper value of your stock as it vests. That’s basically the area under the curve in the figure above. Your stock vesting schedule is probably like “4 years with a 1 year cliff.” If your stock vests during a period of hyper-growth, you will pay hyper-taxes. An 83(b) election fixes this problem.

If you file an 83(b), you are taxed on the value of the stock on the day you receive it, not the day it vests. As a founder on day one, your stock is worth about zero dollars. Your total tax on that will be about zero dollars.

The 83(b) Election Form

The 83(b) form is about a page long. As IRS forms go, that’s pretty mild. The form and cover letter should look roughly like this. Send two copies to the IRS, and include a self-addressed stamped envelope.

As of 2015, you no longer need to include a copy of the 83(b) form with your personal tax return at the end of the year.

Where to Mail your 83(b) Election Form

East Coast. If you live in NY, NJ, VA, CT, DC, MD, MA, or PA, then mail your 83(b) to:

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Texas. If you live in Texas, mail your 83(b) to:

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002

West Coast, Mid-West. If you live in CA, WA, OR, CO, IL, mail your 83(b) to:

Department of the Treasury

Internal Revenue Service

Fresno, CA 93888-0002

Abroad. If you live in a foreign country, mail your 83(b) to:

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

If you live somewhere else, check out 83(b) Elections For Dummies. Account Talent Management, 2012.

Some Links about 83(b) and Startup Taxes

RTFM: IRS Publication 525 - Taxable and Nontaxable Income.

83(b) Elections For Dummies (Account Talent Management, 2012).

The 83b Episode. “So one day I was driving along and realized that the 83b was laying on the passenger seat next to me, unfiled, and it’d been a lonnnnngggggg time since I’d signed it. An icy chill shot through me. I stopped at the nearest post office and, without actually doing the calendar math, fired it off to the feds.” (By Pointy Haired Startup, 2013.)

How do I make an 83(b) election? Clerky, 2015.

What is an 83(b) election? Yokum Taku, 2007. When you receive shares subject to vesting, an 83(b) election lets you pay tax on the shares immediately, when the tax burden is smallest.

What is a Section 83(B) Election and Why Should You File One?. (Cooley Go).

Disclaimer: Consult with your tax advisor before making tax decisions. You are currently reading a blog, not consulting with your tax advisor.